Dyddiad cyhoeddi

Sector diwydiant

Energy regulator Ofgem has today (Friday 23 August, 2024) announced an increase of the energy price cap for the final quarter of 2024.

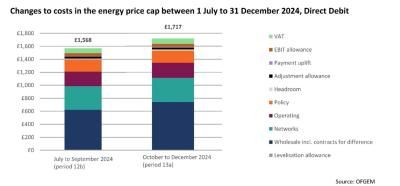

The price cap – which sets a maximum rate per unit and standing charge that can be billed to customers for their energy use – will rise by 10% on the previous quarter from 1 October to 31 December 2024. For an average household paying by direct debit for dual fuel this equates to £1,717 per year, adding around £12 a month to an average bill.

While this is an increase on the previous quarter, the new cap is 6% (£117) cheaper compared to the same period last year (£1,834) and 49% (£1,654) less than 2022 (£3,371) during the energy crisis, which saw the introduction of the Energy Price Guarantee.

Rising prices on the international energy market – due to increasing geopolitical tensions and extreme weather events driving competition for gas – are the primary cause of the rise, accounting for 82% of the increase. Ofgem recognises that any increase will put additional pressure on households and continues to work with the new Government to explore options to support customers that need the most help, as part of an ongoing review of energy affordability.

Ofgem has today also published a paper on options to reduce domestic standing charges and increase the choices available to consumers. Standing charges are the fixed costs on bills that cover getting energy to people’s homes. Options in the short term include diversifying the range of tariffs to give customers more choice on standing charges and moving some of these up-front costs to the unit rate (the price charged for every unit of energy used), and in the long term, reviewing the allocation of network costs.

The options paper follows Ofgem’s call for input on standing charges and highlights choices and trade-offs if changes are implemented that could disproportionately affect low income and customers who are unable to reduce their energy use safely.

The regulator is also reminding customers who are concerned about their bills to contact their supplier and check they are accessing all the support they are eligible for. This follows a campaign launched by the Department for Work and Pensions earlier this week, encouraging the 880,000 households eligible for pension credit to claim it, and other support such as Winter Fuel Payment.

Jonathan Brearley, CEO of Ofgem, said:

“We know that this rise in the price cap is going to be extremely difficult for many households. Anyone who is struggling to pay their bill should make sure they have access to all the benefits they are entitled to, particularly pension credit, and contact their energy company for further help and support.

“I’d also encourage people to shop around and consider fixing if there is a tariff that’s right for you – there are options available that could save you money, while also offering the security of a rate that won’t change for a fixed period.

“We are working with Government, suppliers, charities and consumer groups to do everything we can to support customers, including longer term standing charge reform, and steps to tackle debt and affordability.

“Options such as changing how standing charges are paid and getting suppliers to offer more tariff choices and give customers more control are all on the table, but there are no silver bullets. Any change could leave some low-income households worse off, so it’s important we hear views on our proposals and continue working with the Government to see what targeted support could help customers.

“Ultimately the price rise we are announcing today is driven by our reliance on a volatile global gas market that is too easily influenced by unforeseen international events and the actions of aggressive states. Building a homegrown renewable energy system is the key to lowering bills and creating a sustainable and secure market that works for customers.”

Today Ofgem is also publishing:

- An options paper on standing charges, including a summary of responses to Ofgem’s call for input, which received more than 30,000 responses

- A decision to extend an allowance in the cap for the costs associated with Additional Support Credit (ASC) - an emergency credit which ensures vulnerable prepayment meter consumers remain on supply this winter

- A working paper on supplier operating costs for smart meters included in the price cap

The standing charges options paper is informed by feedback from more than 30,000 customers, consumer groups, charities and stakeholders who responded to Ofgem’s call for input earlier this year.

The standing charge covers the fixed costs for the provision of energy that everyone has to pay. The short-term option presented by the regulator include an option to move between £20 and £100 from the standing charge to the unit rate (the price paid for every unit of energy used), giving customers the opportunity to save money by lowering their usage.

While this option could see some households make savings, Ofgem recognises the significantly higher impact a unit rate increase could have on customers who cannot safely cut their energy use due to dependency on life saving medical equipment or living in a low standard of housing with poor insulation. Analysis by the regulator on scrapping the standing charge and moving all costs to the unit rate also suggests around half a million low income households would see bills increase by around 10 percent.

In the longer term Ofgem has also committed to reviewing network costs, which cover the essential maintenance and upgrades to essential energy infrastructure, to consider if changes can be made to reduce costs further.

In October 2023 Ofgem introduced an initial 12-month allowance to cover increased debt costs associated with providing Additional Support Credit to prepayment meter customers, often at the point of disconnection. The decision to extend this allowance, which is expected to be for another 6 months, reinforces Ofgem’s commitment to using every lever available to ensure that customers that need the help the most are supported and remain on supply this winter.

Notes To Editors

The energy price cap was introduced by the government and has been in place since January 2019, and Ofgem is required to regularly review the level at which it is set. It ensures that an energy supplier can recoup its efficient costs while making sure customers do not pay a higher amount for their energy than they should. The price cap, as set out in law, does this by setting a maximum that suppliers can charge per unit of energy.

Updated number of customers on different tariff types as of July* 2024

New number of customers on Standard Variable Tariffs (SVT) – ‘around 27 million’ of which:

- New no. of SVT Direct Debit customers – ‘around 18 million’

- New no. of SVT Standard Credit customers – ‘around 5 million’

- New no. of SVT PPM customers – ‘around 4 million’

Total number of customers on fixed tariffs ‘around 5 million’ (with the vast majority being non-PPM)

*Latest Financial Responsibility RFI data is for July-24. Tariff and customer Account RFI data is as of July-24 (used to calculate the SVT payment splits).

Changes to costs included in the energy price cap between 1 July to 31 December 2024, Direct Debit

Figures may not sum to total due to rounding.

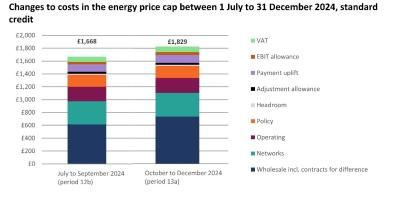

Changes to costs included in the energy price cap between 1 July to 31 December 2024, standard credit

Figures may not sum to total due to rounding.

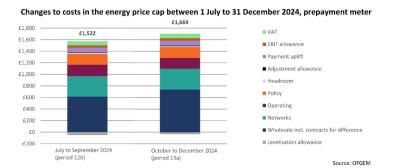

Changes to costs included in the energy price cap between 1 July to 31 December 2024, prepayment meter

Figures may not sum to total due to rounding.