What drives British wholesale gas prices?

- David Hall

- Publication type:

- Blog

- Publication date:

- Industry sector:

- Generation and Wholesale Market,

- Supply and Retail Market

Household energy bills are made up of a number of factors with the largest (about 45%) being wholesale prices. At Ofgem we publish lots of data on wholesale prices. In this blog, our senior economist David Hall looks at the main influences on GB wholesale gas prices and the drivers behind recent price trends.

Bill breakdown: Wholesale costs account for around 45% of a household energy bill.

The UK as a net importer of gas

Since the mid-2000s the UK has been a net importer of gas. Before then our wholesale prices were driven largely by the cost of extracting gas from our own North Sea fields and transporting it to homes and businesses.

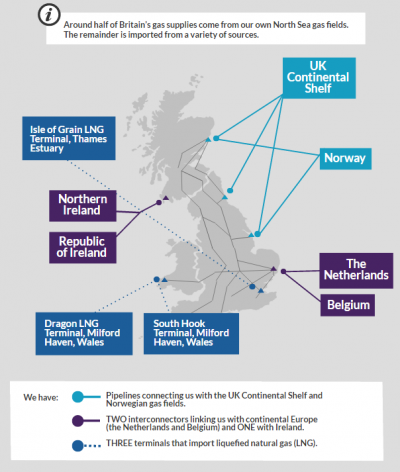

Nowadays around 55% of the UK’s gas comes from its North Sea fields and around 38% comes from Norway. The remainder is imported from continental Europe, or via Liquefied Natural Gas (LNG). A very small amount (around 8% in winter) comes from gas storage. These supply sources compete to meet demand for natural gas, setting the UK’s wholesale gas price.

Over much of the past decade wholesale gas prices have generally risen. But in the last two years prices they have fallen for several reasons which are explained below. We monitor this closely and publish regular updates including this graph on monthly average day-ahead gas prices.

LNG

Many LNG contracts are linked to oil prices. As the price of oil has fallen, so has the price of LNG. This, combined with major worldwide growth and oversupply, has brought about a dramatic fall in LNG prices from more than 100p/therm to current levels below 40p/therm. Britain is one of the biggest gas trading hubs in Europe and it also has three LNG import terminals. So it is well placed to take advantage of this. Cheaper LNG imports are one of the reasons why GB wholesale gas price prices have been falling in recent months.

Demand

Gas is the main fuel used for household central heating so clearly we use more of it when the weather is cold. As a result wholesale gas prices are higher in winter than in summer.

Recent winters have been relatively mild, resulting in lower gas demand for heating. Demand from industrial customers has also been falling. At the same time energy efficiency has improved. All these factors have put downward pressure on demand and prices.

On the other hand, demand from gas-fired power stations is set to increase. More electricity is being generated by gas compared with coal plants which are in decline. National Grid’s Summer Outlook anticipates increased gas demand this summer partly due to gas-fired plants.

Gas supply: Find out more in our infographic guide.

Interconnectors

The UK is connected to Europe via three gas pipelines linking us with Belgium, the Netherlands and Ireland. (There is a pipeline to Norway but this is not regarded as an interconnector as the gas only flows into Britain).

The links with Belgium and the Netherlands allow Britain to import gas when our price is higher, and export it when the price in neighbouring countries is higher. Some long-term continental gas contracts are linked to the price of oil. Similar to LNG, downward pressure on oil prices has been followed by falls in continental gas prices. This benefitted the UK as we imported cheaper European gas through the two pipelines.

Part of Ofgem’s job is to closely monitor wholesale markets to make sure they are working in consumers’ interests. Last year we carried out a detailed study of wholesale markets and our overall conclusion was that the GB markets appear to be competitive. The Competition and Markets Authority also reached the same conclusion in its energy market investigation. We always keep a close eye on wholesale prices and we will publish our next report this summer.

Next winter

GB’s links to Continental and global gas markets have enabled it to benefit from recent oil and gas price declines. For example the forward price for gas for delivery this winter is trading at around 40 p/therm. This is around 8p/therm (around 18%) lower than the price suppliers were paying at this point last year for gas to be delivered in winter 2015-16.